Citizens of the Russian Federation who buy real estate, the law guaranteed makes it possible to obtain a tax on tax. Such a benefit is called - a tax deduction (HB). What is it? What function does it perform?

Content

- Tax deduction when buying an apartment

- Tax deduction when buying a mortgage

- How to get a tax deduction when buying?

- Documents for tax deductions when buying

- Tax deduction when buying an apartment: Dates

- Tax deduction when buying an apartment: when to submit?

- Tax deduction when buying a car

- Tax deduction when buying an apartment: sample

- Video: How to get a tax deduction when buying an apartment?

Tax deduction when buying an apartment

So, what is the tax deduction when buying housing? Officially, any citizen of Russia, who is employed, receives his own ZP with a deduction of PN, which is 13%. Having purchased an apartment and other real estate, a person can return a certain part of the finances spent. He has the right to return 13%, only from the price of real estate itself.

The law of Russia establishes such a limiting line of this price - 2 million rubles. This, of course, is not very pleasing to people, since it is impossible to find anything for such a price. Therefore, if the selected apartment costs much more, the state returns the same 13%, but only from 2 million. You can easily calculate the percentage balance, it is 260 thousand rubles. When real estate is bought in a mortgage, then a person receives an additional bonus.

A few years ago, namely in 2014, a tax deduction could be obtained no more than once. Those people who bought real estate before the 1st of this year could not collect 260 thousand, are simply unlucky. But those who purchased real estate after this date have the opportunity to get the full amount of state support.

Suppose in 2014 the room in a communal apartment cost 1,500,000 rubles, and the return was 195,000 rubles. A person who made such a purchase that decided to buy a one -room apartment will be able to receive 65,000 rubles today, who were not received then.

Tax deduction when buying a mortgage

We already know that HB is a reimbursement of part of the finances to a person that he spent on his own purchase in the account of previously entered taxes in the treasury of our country.

The tax deduction during the acquisition of real estate in a mortgage does not differ from the purchase of cash. The main rules that are described in the legislation are as follows:

- The largest permissible amount of tax deduction when buying is 2 million rubles.

- The right to return is given if property is confirmed at the end of the year, which gives such a right.

- All finances may include: personal, attracted. This does not include overdue payments and penalties.

A mortgage tax agreement is considered paid, it provides for an additional financed contribution. A tax return during the acquisition of real estate in a mortgage has its own advantage.

In addition to the fact that a person returns overpaid tax from the first investments, he also receives 13% of the accruals (not more than 2 million rubles). This possibility is provided if there were grounds initially for this.

A tax deduction when buying with maternity capital is the support of people from the state. In addition to acquiring a certain real estate, people can use the money received for the following purposes:

- Invest in the accumulative pension of mom.

- To invest in the future training of each child.

- Improve your own living conditions.

Often people use the total capital of the family to buy housing. However, the amount of the certificate is not always enough, therefore, you have to invest your own savings.

How to get a tax deduction when buying?

Getting a tax deduction when buying is a simple and affordable procedure. The return of the tax deduction when buying a particular real estate is issued to people, taking into account the amount of taxes paid for the whole year. In order to get the entire amount at once, you need to have a fairly decent income or expect the promised for about 3 years.

Methods of providing property tax deduction when buying two: due to either or thanks to the employer.

How to submit a tax deduction when buying an apartment?

- At the expense of nor. After making a purchase, after a certain time, you go to no. There you get 13% of the finances you have made in the previous year. This amount may not be able to cover the amount of the entire amount, therefore, you have the right to apply again a year later. And so until the moment until you get the entire amount of the right amount.

- In the place where a person is officially employed. After you made a purchase without expecting the completion of the tax period, you go to the employer, tell him that income tax was not withheld from your wage. Therefore, before the end of the desired period, a tax of 13%will not be removed from your salary, as happened earlier.

Documents for tax deductions when buying

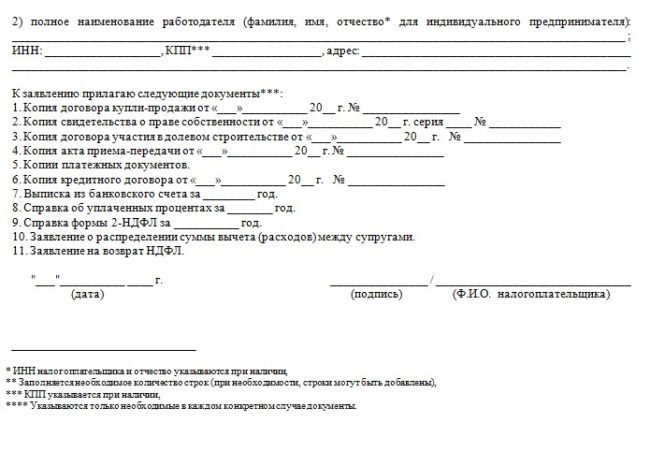

The tax deduction when buying a house, apartment and other real estate requires the submission of certain documents. The most important documents that you need is the following:

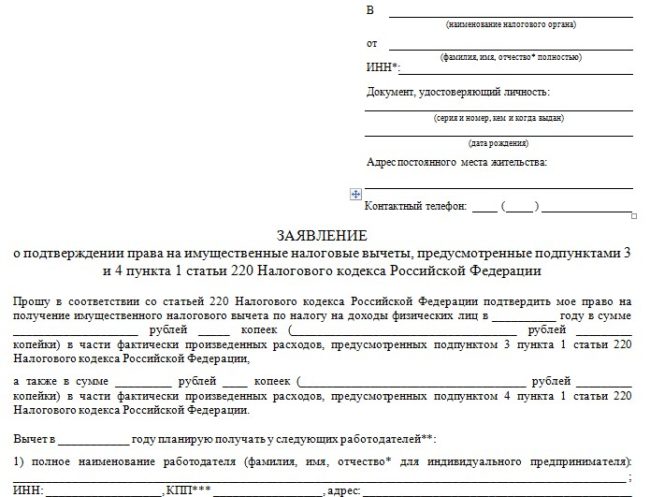

- Application for a tax deduction when buying an apartment. This document is considered important, it turns out only in no.

- An application for the money to be received by the bank. This account should be indicated immediately so that additional problems do not arise.

- An account in a banking institution, a savings book, plus its copy.

- A document confirming. A copy is also necessary.

- TIN.

- A tax deduction declaration upon purchase.

- A document from the place where a person works. If you worked in several companies or at the same time in several work, then this will require a certificate of each employer.

- An agreement that confirms the purchase of an apartment at home. A photocopy is required.

- Receipts that confirm the payment of the value of real estate.

- If you need a tax deduction with a shared purchase of an apartment, then an act is required that real estate was really transferred.

- An extract received in the registration chamber. It confirms the fact that a person owns real estate.

Additional documents:

- Mortgage agreement, plus its copy. In some situations, people are provided with a target loan in order to make a particular purchase of living space. In this case, a loan agreement is required in this case. It contains a item that refers to the disposal of finance for the acquisition of real estate.

- If the documentation is submitted to get HB on a mortgage, then a certificate of interest is required. There are situations when in no need to show receipts on the payment of a loan.

The list of documentation for a tax deduction when buying an apartment with spouses, that is, with joint ownership, the one:

- A document that indicates a distribution to certain shares.

- A document confirming the registration of marriage.

A tax deduction is also provided for pensioners when buying a certain real estate. But only if a pensioner worked in the previous 3 years, plus was a full -fledged tax payer. Compensation is issued to a person at the same time in 3 years. The pensioner himself also provides a pensioner’s certificate, plus his copy.

Can I get a tax deduction when buying an apartment for children? Yes, you can. Then to that documentation it is necessary to add documents for children.

How to make a tax deduction when buying an apartment quickly? It is simply necessary that the documentation be executed without errors. Such a condition helps to avoid unnecessary running around and problems. It is advisable to make copies of documentation a little earlier.

Tax deduction when buying an apartment: Dates

So, you can get a tax deduction when buying a site or apartment with two methods. We wrote about this a little higher. The deadline for the issuance of HB depends on which method of receipt.

At the expense of the duration of obtaining a tax deduction when buying:

- Have you decided to get NV at the main job? Then the whole procedure will last about 30 days. You submit a certificate from the employer and all other documents in the same year when you made a purchase. The inspectors will check all the documents, and after 30 days they will inform you of the size of HB.

- If you decide to get the right to a tax deduction when buying an apartment and other real estate at the expense of nor, then the procedure will last about 3 months. When exactly you will receive HB, it will depend on the correctness of filling out the documentation.

- When conducting a chamber check, you will receive HB after 3 months. If all the documents were originally executed without a single error, then you will receive money after 1 month.

Also, in order to receive a tax deduction for the purchase of an apartment, you need to fill out an application on the Internet. All documentation is drawn up in the personal account of the taxpayer, plus additionally a person visits neither. The design process will take about 1 month.

Tax deduction when buying an apartment: when to submit?

A refund of HB (if a mortgage was received) is issued in the year of official registration of property. When a person receives a “green light”, he automatically receives the right to independently dispose of HB at his discretion.

A person has the right to visit for a year later, 5 years or even 10. But in practice, as a rule, people try to quickly return the finances spent, making a return at the slightest opportunity. If the return is planned to be issued by the employer, a person can draw up NV in one year with the purchase of real estate, thereby receiving compensation every month.

If you need a tax deduction when buying a land plot, for example, for construction, then you can contact until the end of the construction itself. The owner of the construction organization and the owner of the future housing must sign the act on housing and its transfer.

Tax deduction when buying a car

No. You can’t get HB on a car. Such a refund of financial resources in the legislation of the country was not provided. In a word, a person’s deduction has a rule to get a rule in any case, but when it comes to not the vehicle.

This means that the return of funds during the purchase of a car should not even be thought. You just spend your own time in vain. Such a return is not issued to anyone, even to pensioners and those who need it very much.

However, there is one version of the tax deduction during the purchase of a car, only it has a completely different type. He is able to reduce the value of the tax base during the sale of real estate. It is issued to the seller, but only partially. The seller has the right to regain finances by reducing the tax base in the future to pay tax.

Tax deduction when buying an apartment: sample

The following data must be specified in the sample:

- The period for which the tax should be.

- Personal aggregate data.

- The data of the filler, which are indicated in the passport.

- The status of a submitting application.

- Place of residence of a person who submits an application.

- Information that indicate human taxes, his payments made to the state treasury.

- Cash receipts that the citizen received over the past year.

- Information about the purchase of an apartment or the construction of real estate of various types.

- Standard deductions.

We hope that having studied the indicated information, you will not make mistakes when receiving a tax deduction. The main thing is to do everything on time and have the relevant documents, since the state authorities do not tolerate delays and shortcomings.

Comments

a couple of years ago, there was no side of metrogils from the same problem, there were no side effects ...

I’m not a fan of peeling at all, it saves from acne of metrogil, it also smoothes it ...

Great article! ...

I take the second course of the Capsules Climafite 911. The tides went very quickly. It became calmer, irritability went away and I sleep well ...

i also noticed - it is worth nervous, everything immediately affects the face. Therefore, I try to avoid conflicts and unpleasant people. Of the creams, I like Miaflow from wrinkles - smoothes not only small wrinkles ...